Property Taxes For San Bernardino County Ca . Our san bernardino county property tax calculator can estimate your property taxes. Property information is maintained by the assessor's office. Enter the desired mailing address, assessor parcel number (apn), or. pay your property taxes conveniently and securely using our website. If you have questions or would like to correct any. Establishing an assessed value for all. responsible for providing outstanding customer service in the collection of secured and unsecured property taxes. estimate my san bernardino county property tax. search for san bernardino county secured and unsecured properties. the median property tax in san bernardino county, california is $1,997 per year for a home worth the median value of $319,000. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; Free echeck (electronic check) is a digital version of the.

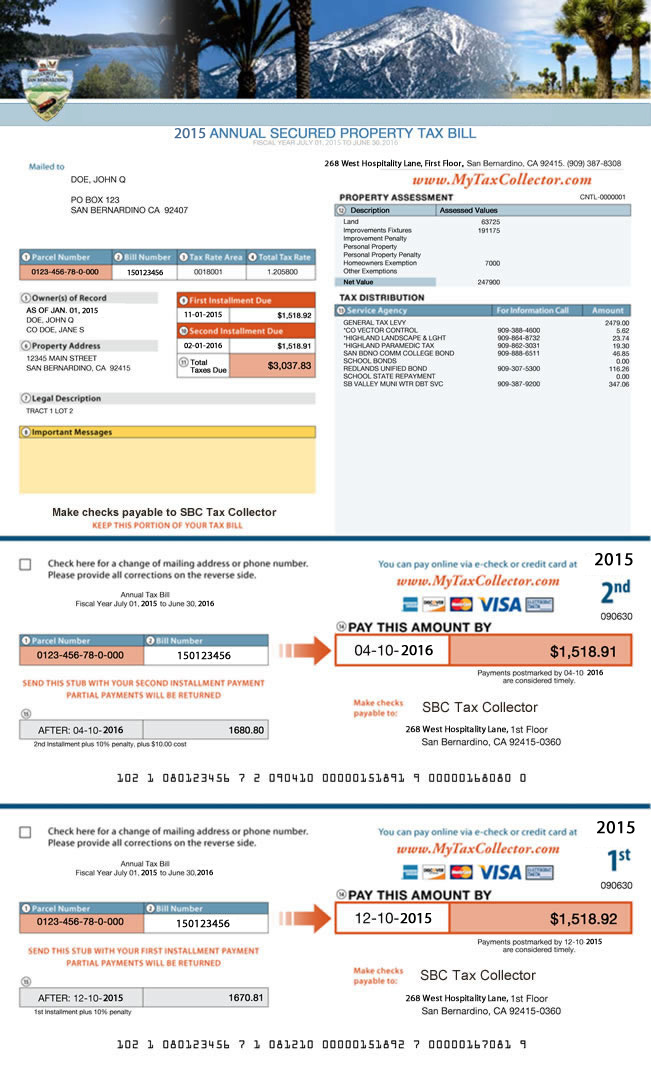

from www.mytaxcollector.com

responsible for providing outstanding customer service in the collection of secured and unsecured property taxes. Enter the desired mailing address, assessor parcel number (apn), or. search for san bernardino county secured and unsecured properties. Establishing an assessed value for all. pay your property taxes conveniently and securely using our website. If you have questions or would like to correct any. estimate my san bernardino county property tax. the median property tax in san bernardino county, california is $1,997 per year for a home worth the median value of $319,000. Our san bernardino county property tax calculator can estimate your property taxes. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino;

County of San Bernardino Tax Collector

Property Taxes For San Bernardino County Ca Property information is maintained by the assessor's office. the median property tax in san bernardino county, california is $1,997 per year for a home worth the median value of $319,000. Enter the desired mailing address, assessor parcel number (apn), or. search for san bernardino county secured and unsecured properties. Our san bernardino county property tax calculator can estimate your property taxes. responsible for providing outstanding customer service in the collection of secured and unsecured property taxes. If you have questions or would like to correct any. estimate my san bernardino county property tax. Property information is maintained by the assessor's office. pay your property taxes conveniently and securely using our website. Establishing an assessed value for all. Free echeck (electronic check) is a digital version of the. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino;

From www.landwatch.com

Pinon Hills, San Bernardino County, CA Recreational Property Property Taxes For San Bernardino County Ca the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; estimate my san bernardino county property tax. pay your property taxes conveniently and securely using our website. Property information is maintained by the assessor's office. search for san bernardino county secured and unsecured properties. Our san bernardino. Property Taxes For San Bernardino County Ca.

From www.realtor.com

San Bernardino County, CA Real Estate & Homes for Sale Property Taxes For San Bernardino County Ca Property information is maintained by the assessor's office. Our san bernardino county property tax calculator can estimate your property taxes. Enter the desired mailing address, assessor parcel number (apn), or. responsible for providing outstanding customer service in the collection of secured and unsecured property taxes. pay your property taxes conveniently and securely using our website. the median. Property Taxes For San Bernardino County Ca.

From www.showcase.com

292 E 40th St San Bernardino, CA 92404 Retail Property for Lease on Property Taxes For San Bernardino County Ca If you have questions or would like to correct any. Free echeck (electronic check) is a digital version of the. Property information is maintained by the assessor's office. Establishing an assessed value for all. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; the median property tax in. Property Taxes For San Bernardino County Ca.

From flipsplit.com

How To Navigate The San Bernardino Property Tax Rate FlipSplit Property Taxes For San Bernardino County Ca pay your property taxes conveniently and securely using our website. search for san bernardino county secured and unsecured properties. Establishing an assessed value for all. responsible for providing outstanding customer service in the collection of secured and unsecured property taxes. Enter the desired mailing address, assessor parcel number (apn), or. Free echeck (electronic check) is a digital. Property Taxes For San Bernardino County Ca.

From uupunutkansalainen.blogspot.com

san bernardino county tax collector change of address Add My Voice Property Taxes For San Bernardino County Ca Enter the desired mailing address, assessor parcel number (apn), or. responsible for providing outstanding customer service in the collection of secured and unsecured property taxes. search for san bernardino county secured and unsecured properties. pay your property taxes conveniently and securely using our website. the assessor is responsible for locating, describing, and identifying ownership of all. Property Taxes For San Bernardino County Ca.

From www.landwatch.com

Twin Peaks, San Bernardino County, CA Recreational Property Property Taxes For San Bernardino County Ca Enter the desired mailing address, assessor parcel number (apn), or. pay your property taxes conveniently and securely using our website. responsible for providing outstanding customer service in the collection of secured and unsecured property taxes. the median property tax in san bernardino county, california is $1,997 per year for a home worth the median value of $319,000.. Property Taxes For San Bernardino County Ca.

From www.yelp.com

SAN BERNARDINO COUNTY TAX COLLECTOR 16 Photos 268 W Hospitality Ln Property Taxes For San Bernardino County Ca responsible for providing outstanding customer service in the collection of secured and unsecured property taxes. the median property tax in san bernardino county, california is $1,997 per year for a home worth the median value of $319,000. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; Enter. Property Taxes For San Bernardino County Ca.

From andersonadvisors.com

San Bernardino County Property Tax Assessor and Tax Collector Property Taxes For San Bernardino County Ca Our san bernardino county property tax calculator can estimate your property taxes. the median property tax in san bernardino county, california is $1,997 per year for a home worth the median value of $319,000. Free echeck (electronic check) is a digital version of the. pay your property taxes conveniently and securely using our website. responsible for providing. Property Taxes For San Bernardino County Ca.

From form-boe-267-l.pdffiller.com

2020 Form CA San Bernardino BOE267L Fill Online, Printable, Fillable Property Taxes For San Bernardino County Ca Establishing an assessed value for all. Free echeck (electronic check) is a digital version of the. Property information is maintained by the assessor's office. pay your property taxes conveniently and securely using our website. the median property tax in san bernardino county, california is $1,997 per year for a home worth the median value of $319,000. Enter the. Property Taxes For San Bernardino County Ca.

From www.landwatch.com

Hinkley, San Bernardino County, CA Undeveloped Land for sale Property Property Taxes For San Bernardino County Ca pay your property taxes conveniently and securely using our website. estimate my san bernardino county property tax. Property information is maintained by the assessor's office. Free echeck (electronic check) is a digital version of the. Our san bernardino county property tax calculator can estimate your property taxes. If you have questions or would like to correct any. . Property Taxes For San Bernardino County Ca.

From lao.ca.gov

Understanding California’s Property Taxes Property Taxes For San Bernardino County Ca Establishing an assessed value for all. Our san bernardino county property tax calculator can estimate your property taxes. Property information is maintained by the assessor's office. estimate my san bernardino county property tax. search for san bernardino county secured and unsecured properties. the assessor is responsible for locating, describing, and identifying ownership of all property within the. Property Taxes For San Bernardino County Ca.

From www.realtor.com

Page 16 San Bernardino County, CA Real Estate & Homes for Sale Property Taxes For San Bernardino County Ca responsible for providing outstanding customer service in the collection of secured and unsecured property taxes. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; If you have questions or would like to correct any. search for san bernardino county secured and unsecured properties. the median property. Property Taxes For San Bernardino County Ca.

From ceanvvcy.blob.core.windows.net

Property Search San Bernardino County Ca at Josephine Smith blog Property Taxes For San Bernardino County Ca pay your property taxes conveniently and securely using our website. search for san bernardino county secured and unsecured properties. the median property tax in san bernardino county, california is $1,997 per year for a home worth the median value of $319,000. responsible for providing outstanding customer service in the collection of secured and unsecured property taxes.. Property Taxes For San Bernardino County Ca.

From traceybaumgartner.blogspot.com

san bernardino county tax collector change of address Tracey Baumgartner Property Taxes For San Bernardino County Ca Enter the desired mailing address, assessor parcel number (apn), or. search for san bernardino county secured and unsecured properties. pay your property taxes conveniently and securely using our website. Free echeck (electronic check) is a digital version of the. estimate my san bernardino county property tax. If you have questions or would like to correct any. . Property Taxes For San Bernardino County Ca.

From countyauditor.org

San Bernardino County Auditor Property County Auditor Property Taxes For San Bernardino County Ca Free echeck (electronic check) is a digital version of the. Our san bernardino county property tax calculator can estimate your property taxes. search for san bernardino county secured and unsecured properties. Property information is maintained by the assessor's office. Establishing an assessed value for all. If you have questions or would like to correct any. the median property. Property Taxes For San Bernardino County Ca.

From www.landwatch.com

Pinon Hills, San Bernardino County, CA Recreational Property Property Taxes For San Bernardino County Ca Establishing an assessed value for all. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; Enter the desired mailing address, assessor parcel number (apn), or. estimate my san bernardino county property tax. If you have questions or would like to correct any. Property information is maintained by the. Property Taxes For San Bernardino County Ca.

From onesyukur09.blogspot.com

san bernardino tax collector auction Merrill Madrigal Property Taxes For San Bernardino County Ca Our san bernardino county property tax calculator can estimate your property taxes. responsible for providing outstanding customer service in the collection of secured and unsecured property taxes. pay your property taxes conveniently and securely using our website. If you have questions or would like to correct any. Free echeck (electronic check) is a digital version of the. . Property Taxes For San Bernardino County Ca.

From www.landwatch.com

San Bernardino, San Bernardino County, CA Commercial Property for sale Property Taxes For San Bernardino County Ca the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; Establishing an assessed value for all. the median property tax in san bernardino county, california is $1,997 per year for a home worth the median value of $319,000. search for san bernardino county secured and unsecured properties. Our. Property Taxes For San Bernardino County Ca.